Here’s a particularly useful list of rules for calculating (math) derivatives:

On the relationship between the S&P 500 and the CBOE Volatility Index (VIX)

Besides going over the course syllabus during the first day of class on Tuesday, January 16, we will also discuss a particularly important “real world” example of financial risk. Specifically, we will study the relationship between realized daily stock market returns (as measured by daily percentage changes in the SP500 stock market index) and changes in forward-looking investor expectations of stock market volatility (as indicated by daily percentage changes in the CBOE Volatility Index (VIX)):

As indicated by this graph (which also appears in the lecture note for the first day of class), daily percentage changes in closing prices for the SP500 (the y-axis variable) and the VIX (the x-axis variable) are strongly negatively correlated with each other. The blue dots are based on 8,574 contemporaneous observations of daily returns for both variables, spanning 34 years starting on January 2, 1990, and ending on January 12, 2024. When we fit a regression line through this scatter diagram, we obtain the following equation:

,

where corresponds to the daily return on the SP500 index and

corresponds to the daily return on the VIX index. The slope of this line (-0.1147) indicates that on average, daily closing SP500 returns are inversely related to daily closing VIX returns. Furthermore, nearly half of the variation in the stock market return during this period (specifically, 48.87%) can be statistically “explained” by changes in volatility, and the correlation between

and

during this period is -0.70. While a correlation of -0.70 does not imply that daily closing values for

and

always move in opposite directions, it does suggest that this will be the case more often than not. Indeed, closing daily values recorded for

and

during this period moved inversely 78% of the time.

You can also see how the relationship between the SP500 and VIX evolves prospectively by entering http://finance.yahoo.com/quotes/^GSPC,^VIX into your web browser’s address field.

Midterm Exam 1 Formula Sheet and Helpful Hints

The formula sheet for Midterm Exam 1 can be downloaded from the following URL: http://fin4335.garven.com/spring2024/formulas_part1.pdf.

Midterm Exam 1 consists of four problems, of which you must solve three. If you attempt all four, only the three highest-scoring problems will count towards your Midterm Exam 1 grade. Each problem has a value of 32 points, and you will receive an additional 4 points for including your name on the front page of the exam booklet. Thus, the maximum score possible for Midterm Exam 1 is 100 points.

On the exam, it is important not only to neatly and concisely present your analysis but also to provide thorough explanations that showcase your understanding of the concepts being examined.

I believe the information provided in this blog post and the guidance offered in the study guide titled “Finance 4335 Midterm 1 Synopsis” should help everyone prepare well for the upcoming midterm exam.

Good luck!

The 17 equations that changed the course of history (spoiler alert: we use 3 of these equations in Finance 4335!)

Equations (2), (3), and (7) from this list play particularly important roles in Finance 4335!

From Ian Stewart’s book, these 17 math equations changed the course of human history.

Calculus and Probability & Statistics recommendations…

Since many of the topics covered in Finance 4335 require a basic knowledge and comfort level with algebra, differential calculus, and probability & statistics, the second class meeting will include a mathematics tutorial, and the third and fourth class meetings will cover probability & statistics. I know of no better online resource for brushing up on (or learning for the first time) these topics than the Khan Academy.

So here are my suggestions for Khan Academy videos that cover these topics (unless otherwise noted, all sections included in the links which follow are recommended):

- Algebra: Intro to the Binomial Theorem, Pascal’s Triangle and Binomial Expansion

- Calculus: Taking derivatives, Optimization (profit maximization) with calculus, Visualizing Taylor Series for e^x

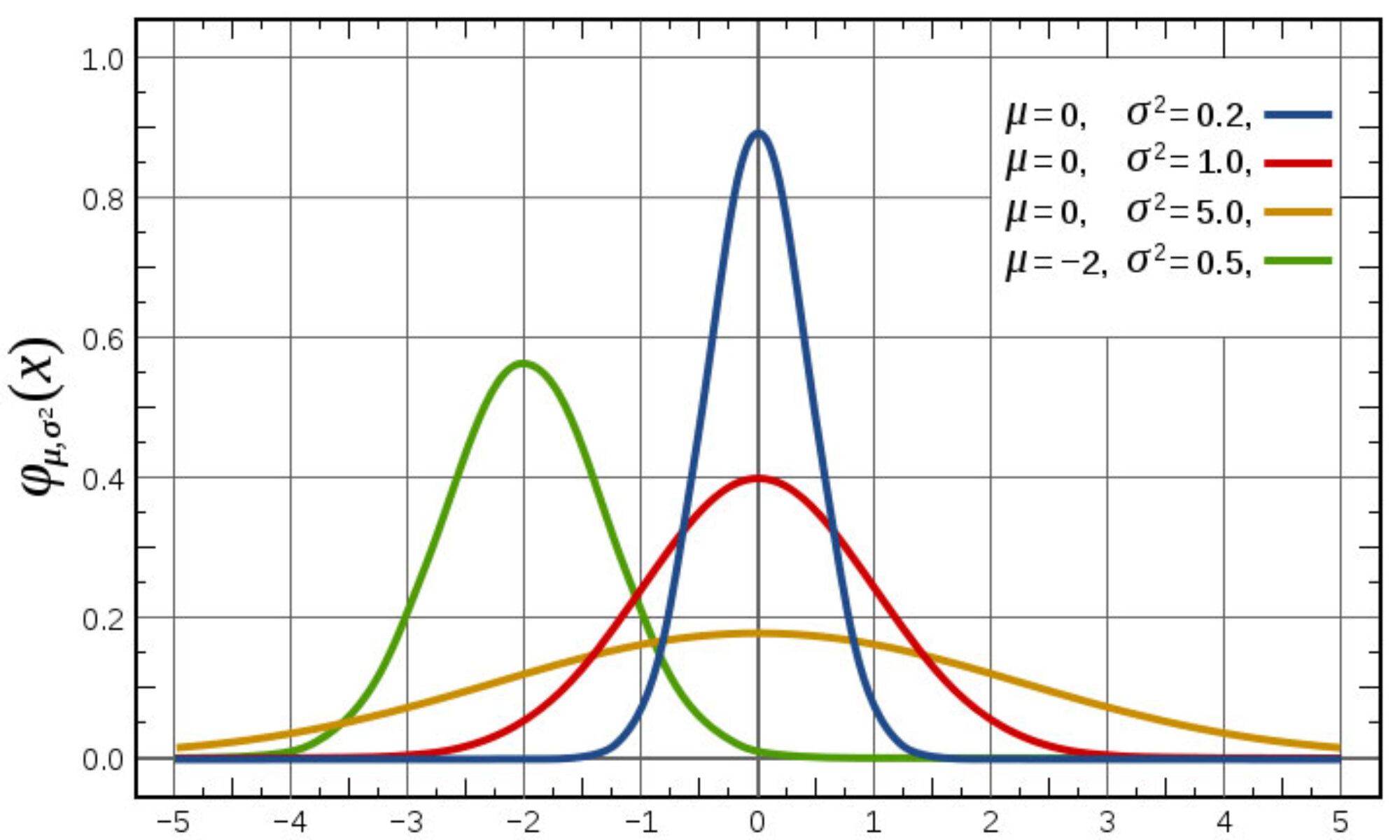

- Probability and statistics: Basic probability, Compound, independent events, Permutations, Combinations, probability using combinatorics, Random variables and probability distributions, Binomial distribution, Law of Large Numbers, and Normal Distribution.

Finally, if your algebra skills are a bit on the rusty side, I would also recommend checking out the Khan Academy’s review of algebra.

Important notice concerning Section III.C.16 of Baylor’s Honor Code Policy and Procedures document

According to Section III.C.16 of Baylor’s Honor Code Policy and Procedures, using, uploading, downloading, or purchasing any online resource that has been derived from material pertaining to a Baylor course without the written permission of the professor constitutes dishonorable conduct; i.e., an act of academic dishonesty. Section IV.A. of the same document obligates faculty members who suspect that a student has engaged in dishonorable conduct of this sort to either handle the matter directly with the student or refer it to the Honor Council.

While you may use course-related documents that I distribute in class and on the course website for strictly personal academic purposes, anything other than your personal use of these documents is in violation of Section III.C.16 of Baylor’s Honor Code Policy and Procedures and therefore, expressly forbidden. Examples include sharing course-related documents with students who are not enrolled in Finance 4335 and uploading such documents to so-called course-sharing websites such as Quizlet, Coursehero, and Chegg, etc. Furthermore, the use of course-related documents (e.g., old problem sets and exams) from any other source other than me also represents an honor code violation.

I close by citing the “Academic Honesty and Integrity” section of the Finance 4335 course syllabus:

Plagiarism, or any form of cheating, involves a breach of student-teacher trust. This means that work on quizzes, problem sets, and exams submitted under your name is expected to be your own, neither composed by anyone else as a whole or in part, nor handed over to another person for complete or partial revision. Instances of plagiarism, or any other act of academic dishonesty, will be reported to the Honor Council and may result in failure of the course or expulsion from the University.

Baylor’s honor code and the Finance 4335 honor code are important resources for understanding various types of academic dishonesty, and I expect my students to be intimately familiar with both of these documents. The standards set forth in both of these honor codes will be applied to all of your work in Finance 4335.