An important clarification of the logical principles behind the stochastic dominance model

On problem set 4, part D, most of you had no apparent difficulty in correctly establishing that the sum of the differences between the cumulative distribution (CDF) for risk 2 and the CDF for risk 1 is positive. However, many of you drew the wrong conclusion, claiming that since the sum of differences between and

came out to a positive number, it followed that risk 2 second order stochastically dominates risk 1. Actually, this result implies the opposite; i.e., that risk 1 second order stochastically dominates 2. This blog posting aims to clarify everyone’s understanding of the logic behind the stochastic dominance model.

The one-page exam formula sheet includes section 4, which explains that risk i dominates risk j, in both the first and second cases when 1) the cumulative distribution function (CDF) of the ith risk is either less than or equal to the CDF of the jth risk for all states (first order dominance), or 2) the sum of the differences between the jth risk CDF and the ith risk CDF for all states is positive (second order dominance):

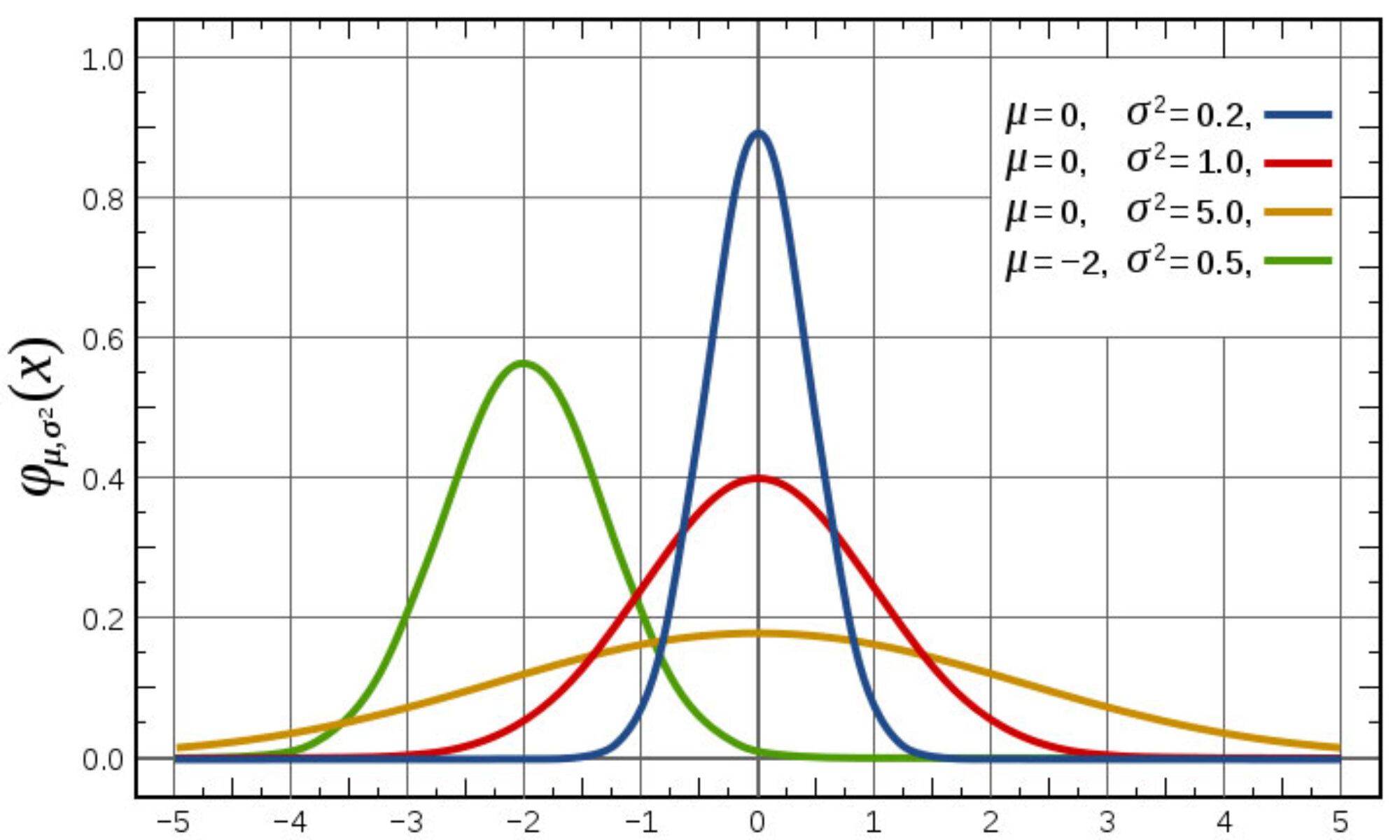

While the math behind first and second order stochastic dominance is summarized in my optional reading entitled “Technical Note on Stochastic Dominance and Expected Utility”, the intuition for first and second order stochastic dominance can be seen in the figures featured on pages 9 and 12 of my Decision-Making under Risk and Uncertainty, part 4 lecture note.

While the math behind first and second order stochastic dominance is summarized in my optional reading entitled “Technical Note on Stochastic Dominance and Expected Utility”, the intuition for first and second order stochastic dominance can be seen in the figures featured on pages 9 and 12 of my Decision-Making under Risk and Uncertainty, part 4 lecture note.

In the above figure from page 9 of my Decision-Making under Risk and Uncertainty, part 4 lecture note, the G risk has 50% of a $0 payoff, and 25% each of a $10 payoff and a $100 payoff. The F risk involves removing 25 percentage points off the $0 payoff and adding 25 percentage points extra to the $100 payoff, and both F and G have a 25% probability of $10 payoffs. Graphically, this ensures that F first order stochastically dominates G; i.e., G(Ws) is greater than or equal to F(Ws) for all s, which also implies that EF[U(W)] > EG[U(W)]. Intuitively, the picture which gets rendered by this analysis shows that most of the probability mass of the stochastically dominant risk (in this case, F) lies below the probability mass of the stochastically dominated risk (in this case, G). Furthermore, since risk F first order stochastically dominates risk G, risk F also second order stochastically dominates risk G because G(Ws) – F(Ws) > 0 for $0 and $10 payoffs, and G(Ws) – F(Ws) = 0 for the $100 payoff.

Next consider the figure from page 12 of my Decision-Making under Risk and Uncertainty, part 4 lecture note:

Here, G(Ws) – F(Ws) > 0 for payoffs ranging from 1-5, G(Ws) – F(Ws) < 0 for payoffs ranging from 5-8, and G(Ws) – F(Ws) = 0 payoffs ranging from 8-12. Thus, there is no first order dominance. However, since the positive difference between G(Ws) – F(Ws) for payoffs ranging from 1-5 exceeds the negative difference between G(Ws) – F(Ws) for payoffs ranging from 5-8, the sum of G(Ws) – F(Ws) over the entire range of payoffs comes out positive. Thus, risk F second order stochastically dominates risk G, which also implies that EF[U(W)] > EG[U(W)].

Finance 4335 student query about availability of Sample Midterm 1 Exam Booklet and Midterm Exam 1 Formula Sheet

From: Finance 4335 Student <Finance_4335_Student@baylor.edu>

Date: Monday, February 12, 2024 at 3:10 PM

To: Garven, James <James_Garven@baylor.edu>

Subject: FIN 4335 Midterm Exam 1

Good Morning, Dr. Garven,

I have a quick question about the Midterm Exam 1 next week. I would like to know when the Sample Midterm 1 Exam Booklet and the Midterm Exam 1 Formula Sheet will be available.

Also, can we use the Midterm Exam 1 Formula Sheet formula sheet on the exam?

Best,

Finance 4335 Student

_________________________________________________________

From: Garven, James <James_Garven@baylor.edu>

Sent: Monday, February 12, 2024 at 5:24 PM

To: Finance 4335 Student <Finance_4335_Student@baylor.edu>

Subject: Re: FIN 4335 Midterm Exam 1

Dear Finance 4335 Student,

My answer to both of your questions is yes. I have already uploaded the Sample Midterm Exam #1 to the course website so that students have ample time to review it before the Midterm Exam #1 Review Session, which is scheduled for our class meeting on Thursday, February 15.

Regarding the Midterm Exam #1 Formula Sheet, I have also uploaded this document to the course website (@ http://fin4335.garven.com/spring2024/formulas_part1.pdf), and I will include this same document as an attachment to the Midterm Exam #1 booklet on the exam day itself, which is Tuesday, February 20.

Dr. Garven

Finance 4335 Grades on Canvas

Here is a “heads-up” about the Finance 4335 grade book on Canvas. There, you will find grade averages that reflect 1) attendance/participation grades for the first four class meetings, 2) two quiz grades and a student survey completion grade which counts as a quiz grade, and 3) problem set 1. Thus, your current (Monday, January 29) course numeric grade in Finance 4335 is based on the following equation:

(1) Current Course Numeric Grade = (.10(Attendance and Participation) +.10(Quizzes) +.20(Problem Sets))/.4

Note that equation (1) is a special case of the final course numeric grade equation (equation (2) below) which also appears in the “Grade Determination” section of the course syllabus:

(2) Final Course Numeric Grade =.10(Attendance and Participation) +.10(Quizzes) +.20(Problem Sets) + Max{.20(Midterm Exam 1) +.20(Midterm Exam 2) +.20(Final Exam), .20(Midterm Exam 1) +.40(Final Exam), .20(Midterm Exam 2) +.40(Final Exam)}

My goal going forward is for the Finance 4335 grade book to dynamically incorporate new grade information on a timely basis for each student, consistent with the final course numeric grade equation. For example, after midterm 1 grading is complete, equation (3) will be used to determine your numeric course grade:

(3) Course Numeric Grade after Midterm 1 = (.10(Attendance and Participation) +.10(Quizzes) +.20(Problem Sets) +.20(Midterm 1))/.6

After midterm 2 grades are recorded, equation (4) will be used to determine your numeric course grade then:

(4) Course Numeric Grade after Midterm 2 = (.10(Attendance and Participation) +.10(Quizzes) +.20(Problem Sets) +.20(Midterm 1) +.20(Midterm 2))/.8

After the spring semester and the final exam period are over, all Finance 4335-related grades will have been collected, and I will use equation 2 above to calculate your final course numeric grade. At that time, your final course letter grade will be based on the following schedule (which appears in the “Grade Determination” section of the course syllabus):

| A | 93-100% | C | 73-77% |

| A- | 90-93% | C- | 70-73% |

| B+ | 87-90% | D+ | 67-70% |

| B | 83-87% | D | 63-67% |

| B- | 80-83% | D- | 60-63% |

| C+ | 77-80% | F | <60% |

Gamma Iota Sigma Chapter Meeting

Gamma Iota Sigma (GIS) is an international collegiate professional fraternity established in 1966 at the Ohio State University in Columbus, Ohio. Baylor University’s Alpha Pi chapter of GIS was founded in 2001. GIS aims to promote, encourage, and sustain student interest in insurance, risk management, and actuarial science as professions. Additionally, it seeks to enhance the moral and scholastic achievements of chapter members while fostering interaction between Baylor University and the business community through research activities, scholarship, and networking opportunities.

Join us for the inaugural chapter meeting of the Spring 2024 semester on Thursday, January 25, from 6:30 to 7:30 pm in Foster 322. We look forward to your participation!

This week in Finance 4335

This week, we will cover a two-part statistics tutorial based on the Statistics Tutorial, Part 1 and Part 2 lecture notes (items 3 and 4 on the Lecture Notes page).

Due tomorrow (1/23):

- Readings listed for January 23 on the Readings page,

- Quiz 2 (Based on these readings), available from https://baylor.instructure.com/courses/197678/quizzes/374484.

- Problem Set 1 (Based on the Math tutorial last Thursday, available as item 2 on the Problem Sets page); turn in at https://baylor.instructure.com/courses/197678/assignments/1913927.

Important notice concerning Section III.C.16 of Baylor’s Honor Code Policy and Procedures document

According to Section III.C.16 of Baylor’s Honor Code Policy and Procedures, using, uploading, downloading, or purchasing any online resource that has been derived from material pertaining to a Baylor course without the written permission of the professor constitutes dishonorable conduct; i.e., an act of academic dishonesty. Section IV.A. of the same document obligates faculty members who suspect that a student has engaged in dishonorable conduct of this sort to either handle the matter directly with the student or refer it to the Honor Council.

While you may use course-related documents that I distribute in class and on the course website for strictly personal academic purposes, anything other than your personal use of these documents is in violation of Section III.C.16 of Baylor’s Honor Code Policy and Procedures and therefore, expressly forbidden. Examples include sharing course-related documents with students who are not enrolled in Finance 4335 and uploading such documents to so-called course-sharing websites such as Quizlet, Coursehero, and Chegg, etc. Furthermore, the use of course-related documents (e.g., old problem sets and exams) from any other source other than me also represents an honor code violation.

I close by citing the “Academic Honesty and Integrity” section of the Finance 4335 course syllabus:

Plagiarism, or any form of cheating, involves a breach of student-teacher trust. This means that work on quizzes, problem sets, and exams submitted under your name is expected to be your own, neither composed by anyone else as a whole or in part, nor handed over to another person for complete or partial revision. Instances of plagiarism, or any other act of academic dishonesty, will be reported to the Honor Council and may result in failure of the course or expulsion from the University.

Baylor’s honor code and the Finance 4335 honor code are important resources for understanding various types of academic dishonesty, and I expect my students to be intimately familiar with both of these documents. The standards set forth in both of these honor codes will be applied to all of your work in Finance 4335.