Since many of the topics covered in Finance 4335 require a basic knowledge and comfort level with algebra, differential calculus, and probability & statistics, the second class meeting will include a mathematics tutorial, and the third and fourth class meetings will cover probability & statistics. I know of no better online resource for brushing up on (or learning for the first time) these topics than the Khan Academy.

So here are my suggestions for Khan Academy videos that cover these topics (unless otherwise noted, all sections included in the links which follow are recommended):

- Algebra: Intro to the Binomial Theorem, Pascal’s Triangle and Binomial Expansion

- Calculus: Taking derivatives, Optimization (profit maximization) with calculus, Visualizing Taylor Series for e^x

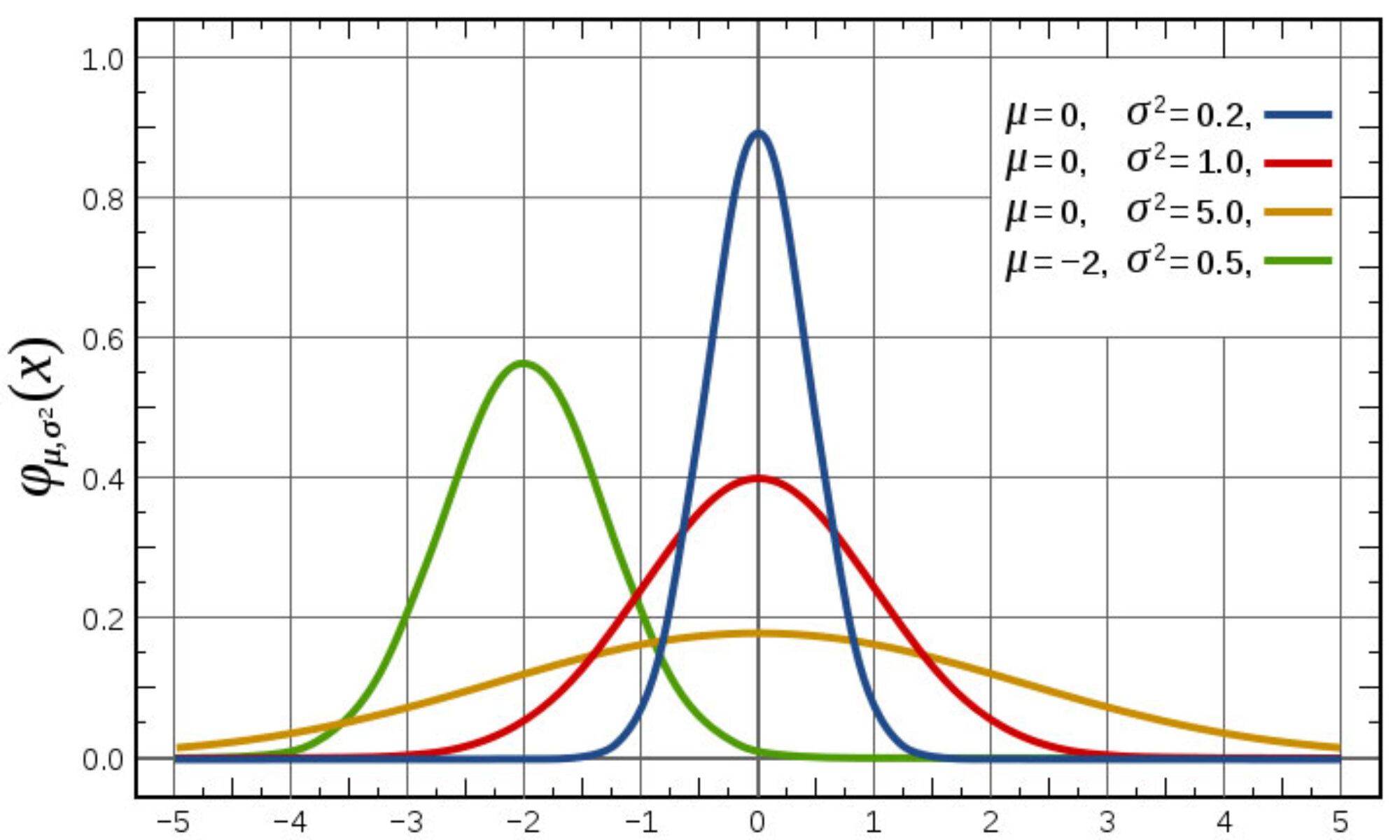

- Probability and statistics: Basic probability, Compound, independent events, Permutations, Combinations, probability using combinatorics, Random variables and probability distributions, Binomial distribution, Law of Large Numbers, and Normal Distribution.

Finally, if your algebra skills are a bit on the rusty side, I would also recommend checking out the Khan Academy’s review of algebra.