Problem sets and quizzes are due before the start of class on the day on which they are assigned. Problem sets must be in PDF format and uploaded to Canvas (instructions for doing so are available in the document titled “How to scan assignments to PDF and post to Canvas”). If the assignment you turn in has multiple pages, please consolidate your assignment into a single PDF file.

Gamma Iota Sigma Chapter Meeting

Gamma Iota Sigma (GIS) is an international collegiate professional fraternity established in 1966 at the Ohio State University in Columbus, Ohio. Baylor University’s Alpha Pi chapter of GIS was founded in 2001. GIS aims to promote, encourage, and sustain student interest in insurance, risk management, and actuarial science as professions. Additionally, it seeks to enhance the moral and scholastic achievements of chapter members while fostering interaction between Baylor University and the business community through research activities, scholarship, and networking opportunities.

Join us for the inaugural chapter meeting of the Spring 2024 semester on Thursday, January 25, from 6:30 to 7:30 pm in Foster 322. We look forward to your participation!

Statistics Class Problem and Solutions

Here is the statistics class problem (and solutions) covered during today’s meeting of Finance 4335:

This week in Finance 4335

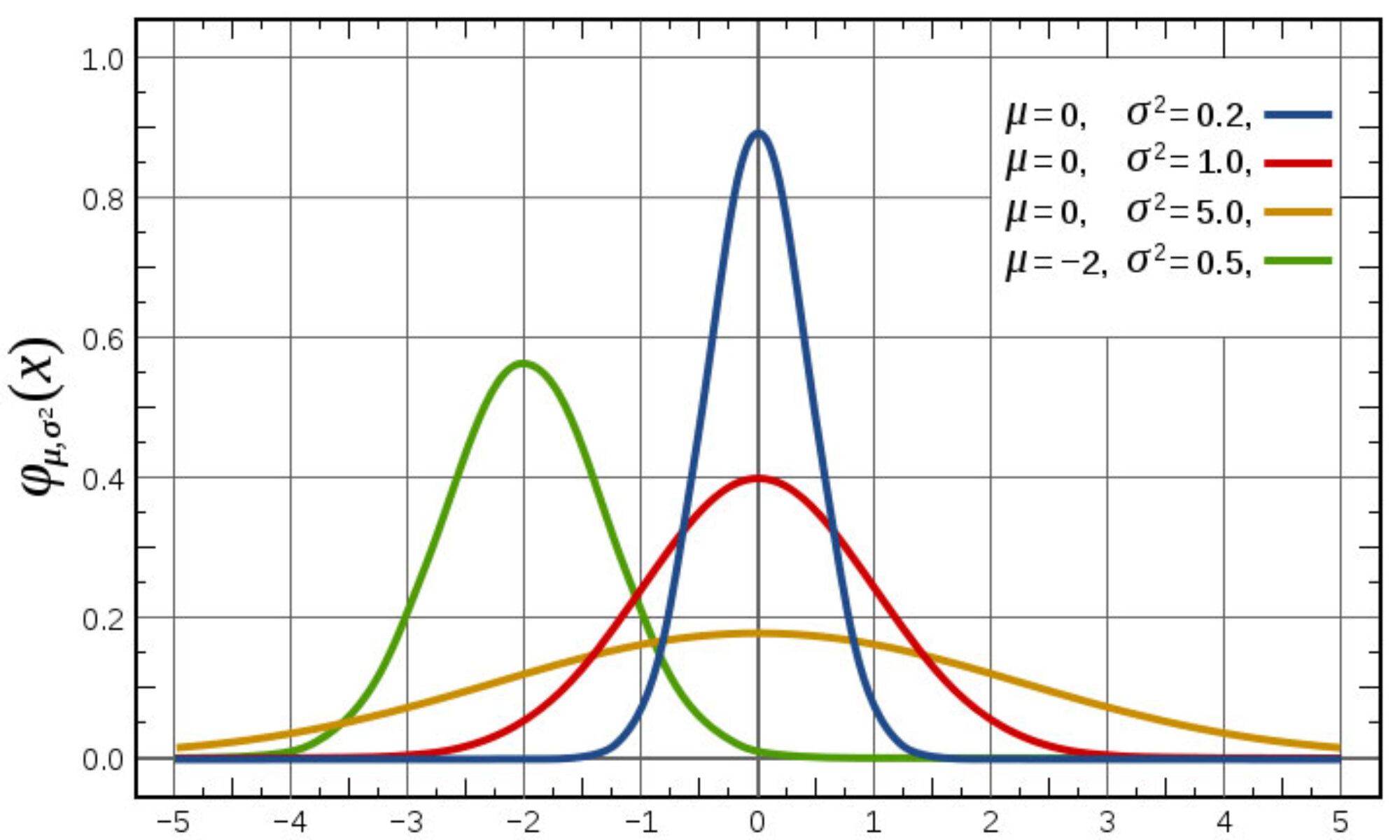

This week, we will cover a two-part statistics tutorial based on the Statistics Tutorial, Part 1 and Part 2 lecture notes (items 3 and 4 on the Lecture Notes page).

Due tomorrow (1/23):

- Readings listed for January 23 on the Readings page,

- Quiz 2 (Based on these readings), available from https://baylor.instructure.com/courses/197678/quizzes/374484.

- Problem Set 1 (Based on the Math tutorial last Thursday, available as item 2 on the Problem Sets page); turn in at https://baylor.instructure.com/courses/197678/assignments/1913927.

Finance: Insights into its meanings, etymology, and more from the Oxford English Dictionary

Kudos to my colleague Dr. Seward for bringing to our attention the many fascinating historical perspectives on the word “Finance” which appear in the Oxford English Dictionary:

Finance in the Oxford English DictionaryTo download this PDF document, click here.

On the ancient origin of the word “algorithm”

The January 23rd assigned reading entitled “The New Religion of Risk Management” (by Peter Bernstein, March-April 1996 issue of Harvard Business Review) offers a concise overview of the same author’s 1996 book entitled “Against the Gods: The Remarkable Story of Risk“. An intriguing excerpt from page 33 of “Against the Gods” elucidates the historical roots of the word “algorithm”:

“The earliest known work in Arabic arithmetic was written by alKhowarizmi, a mathematician who lived around 825, some four hundred years before Fibonacci. Although few beneficiaries of his work are likely to have heard of him, most of us know of him indirectly. Try saying “alKhowarizmi” fast. That’s where we get the word “algorithm,” which means rules for computing.”

Visualizing Taylor Polynomials

On pp. 18-23 of the Mathematics Tutorial, I show how y = ex can be approximated with a Taylor polynomial centered at x=0 for values ranging from -2 to +2. In his video lesson entitled “Visualizing Taylor polynomial approximations”, Sal Kahn essentially replicates my work; the only difference between Sal’s numerical example and mine is that Sal approximates y = ex with a Taylor polynomial centered at x=3 instead of x=0. The important insight provided in both cases is that the accuracy of Taylor polynomial approximations increases as the order of the polynomial increases.

How to know whether you are on track with Finance 4335 assignments

At any point throughout this semester, you can ensure that you are on track with Finance 4335 assignments by monitoring due dates on Canvas and the course website. Links for future class meetings, quizzes, problem sets, and exams appear on the Canvas “To Do” list. Links for readings (along with their due dates) appear on http://fin4335.garven.com/readings/, and links for problem sets (along with their due dates) appear on http://fin4335.garven.com/problem-sets/. In the case of assigned readings, students are required to complete a short (10-minute) readings quiz before the start of class for each reading assignment due date; the window for completing this task begins 24 hours before the start of the class meeting for which the reading assignment is due.

Rules for calculating (math) derivatives

On the relationship between the S&P 500 and the CBOE Volatility Index (VIX)

Besides going over the course syllabus during the first day of class on Tuesday, January 16, we will also discuss a particularly important “real world” example of financial risk. Specifically, we will study the relationship between realized daily stock market returns (as measured by daily percentage changes in the SP500 stock market index) and changes in forward-looking investor expectations of stock market volatility (as indicated by daily percentage changes in the CBOE Volatility Index (VIX)):

As indicated by this graph (which also appears in the lecture note for the first day of class), daily percentage changes in closing prices for the SP500 (the y-axis variable) and the VIX (the x-axis variable) are strongly negatively correlated with each other. The blue dots are based on 8,574 contemporaneous observations of daily returns for both variables, spanning 34 years starting on January 2, 1990, and ending on January 12, 2024. When we fit a regression line through this scatter diagram, we obtain the following equation:

,

where corresponds to the daily return on the SP500 index and

corresponds to the daily return on the VIX index. The slope of this line (-0.1147) indicates that on average, daily closing SP500 returns are inversely related to daily closing VIX returns. Furthermore, nearly half of the variation in the stock market return during this period (specifically, 48.87%) can be statistically “explained” by changes in volatility, and the correlation between

and

during this period is -0.70. While a correlation of -0.70 does not imply that daily closing values for

and

always move in opposite directions, it does suggest that this will be the case more often than not. Indeed, closing daily values recorded for

and

during this period moved inversely 78% of the time.

You can also see how the relationship between the SP500 and VIX evolves prospectively by entering http://finance.yahoo.com/quotes/^GSPC,^VIX into your web browser’s address field.