On problem set 4, part D, most of you had no apparent difficulty in correctly establishing that the sum of the differences between the cumulative distribution (CDF) for risk 2 and the CDF for risk 1 is positive. However, many of you drew the wrong conclusion, claiming that since the sum of differences between and

came out to a positive number, it followed that risk 2 second order stochastically dominates risk 1. Actually, this result implies the opposite; i.e., that risk 1 second order stochastically dominates 2. This blog posting aims to clarify everyone’s understanding of the logic behind the stochastic dominance model.

The one-page exam formula sheet includes section 4, which explains that risk i dominates risk j, in both the first and second cases when 1) the cumulative distribution function (CDF) of the ith risk is either less than or equal to the CDF of the jth risk for all states (first order dominance), or 2) the sum of the differences between the jth risk CDF and the ith risk CDF for all states is positive (second order dominance):

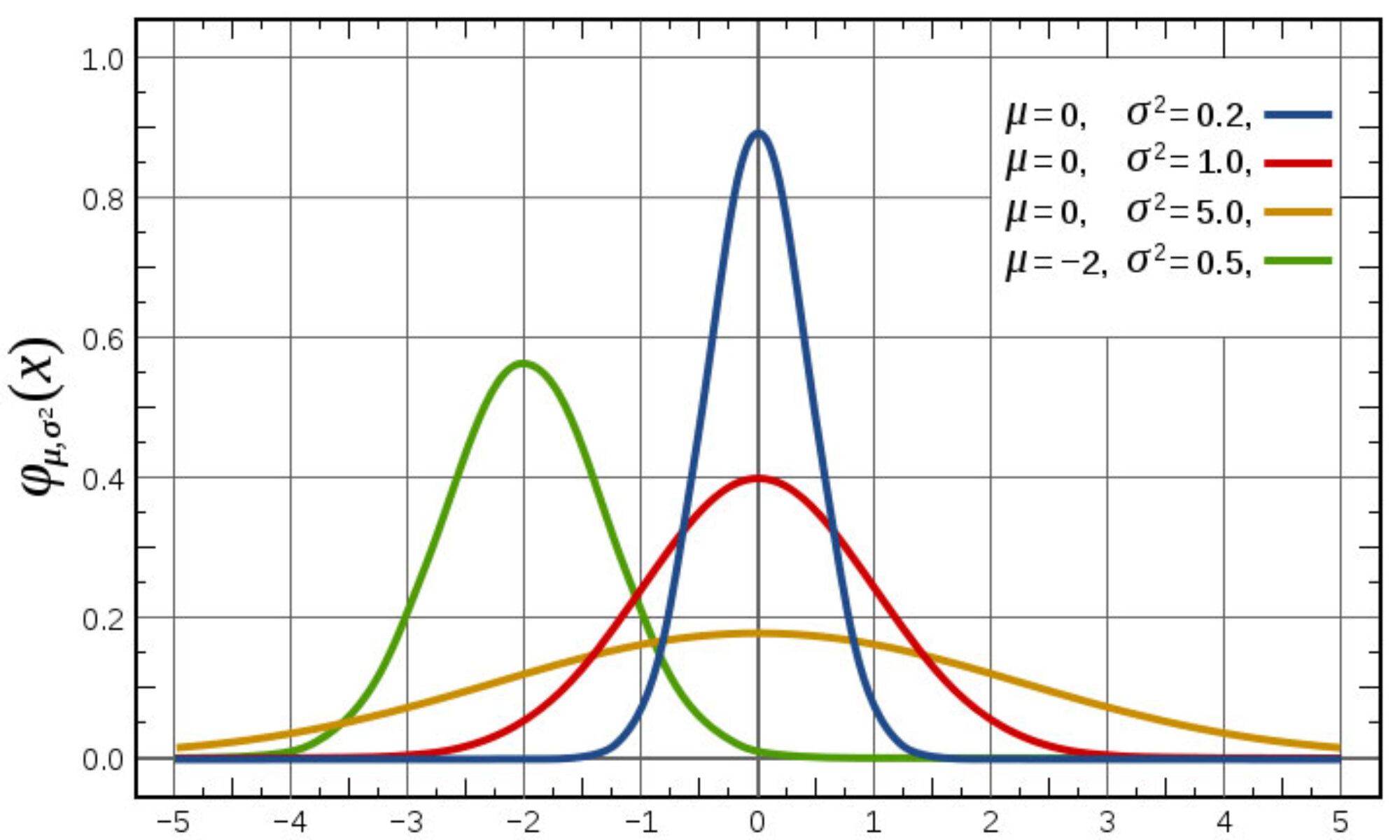

While the math behind first and second order stochastic dominance is summarized in my optional reading entitled “Technical Note on Stochastic Dominance and Expected Utility”, the intuition for first and second order stochastic dominance can be seen in the figures featured on pages 9 and 12 of my Decision-Making under Risk and Uncertainty, part 4 lecture note.

While the math behind first and second order stochastic dominance is summarized in my optional reading entitled “Technical Note on Stochastic Dominance and Expected Utility”, the intuition for first and second order stochastic dominance can be seen in the figures featured on pages 9 and 12 of my Decision-Making under Risk and Uncertainty, part 4 lecture note.

In the above figure from page 9 of my Decision-Making under Risk and Uncertainty, part 4 lecture note, the G risk has 50% of a $0 payoff, and 25% each of a $10 payoff and a $100 payoff. The F risk involves removing 25 percentage points off the $0 payoff and adding 25 percentage points extra to the $100 payoff, and both F and G have a 25% probability of $10 payoffs. Graphically, this ensures that F first order stochastically dominates G; i.e., G(Ws) is greater than or equal to F(Ws) for all s, which also implies that EF[U(W)] > EG[U(W)]. Intuitively, the picture which gets rendered by this analysis shows that most of the probability mass of the stochastically dominant risk (in this case, F) lies below the probability mass of the stochastically dominated risk (in this case, G). Furthermore, since risk F first order stochastically dominates risk G, risk F also second order stochastically dominates risk G because G(Ws) – F(Ws) > 0 for $0 and $10 payoffs, and G(Ws) – F(Ws) = 0 for the $100 payoff.

Next consider the figure from page 12 of my Decision-Making under Risk and Uncertainty, part 4 lecture note:

Here, G(Ws) – F(Ws) > 0 for payoffs ranging from 1-5, G(Ws) – F(Ws) < 0 for payoffs ranging from 5-8, and G(Ws) – F(Ws) = 0 payoffs ranging from 8-12. Thus, there is no first order dominance. However, since the positive difference between G(Ws) – F(Ws) for payoffs ranging from 1-5 exceeds the negative difference between G(Ws) – F(Ws) for payoffs ranging from 5-8, the sum of G(Ws) – F(Ws) over the entire range of payoffs comes out positive. Thus, risk F second order stochastically dominates risk G, which also implies that EF[U(W)] > EG[U(W)].