Here are some helpful hints to consider for Problems 1 and 2 on Problem Set 8 (Problem Set 8 is due by 11 am this Tuesday):

- Problem 1, Part A: Since the call option described in Problem 1, Part A is initially out-of-the-money (i.e., since S = $18 and K = $20), there will be terminal nodes at which the call option expires in-the-money and others at which it expires out-of-the-money. By solving the

equation and rounding to the nearest integer greater than b (referred to in the CRR equation below as the parameter “a“), this indicates the minimum number of up moves required such that this call option expires in–the–money. Once you have this information, you can consider only those terminal nodes at which the call option expires in-the-money (which are nodes a through n) and calculate the call option price by applying the CRR call option pricing equation:

- Problem 1, Part B: Apply the put-call parity equation (

) to solve for the put option price.

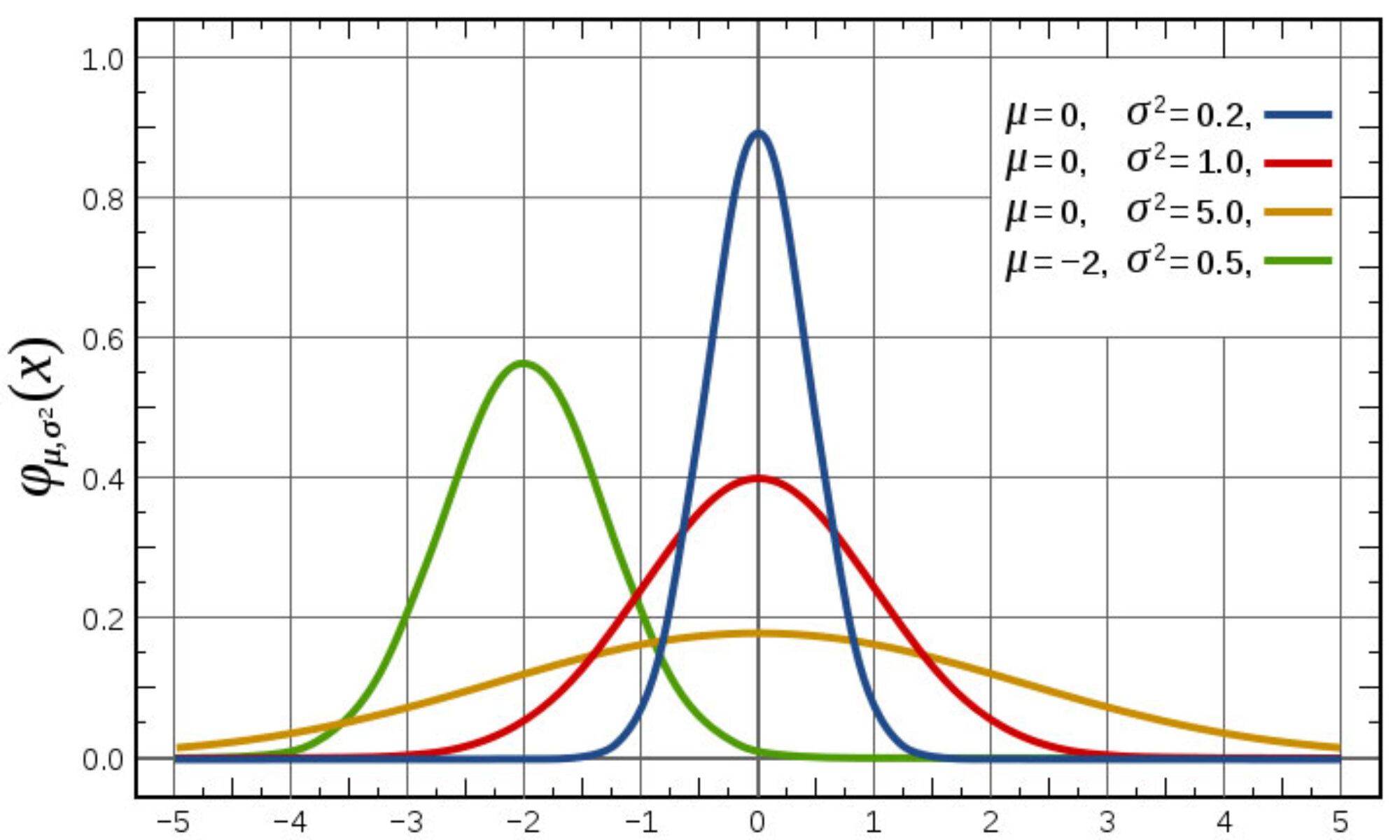

- Problem 2, (Scenario A): requires solving for call and put option prices using the Black-Scholes-Merton option pricing formulas. See the Part 2 option pricing lecture note, page 18, for a numerical illustration of how to do this.

- Problem 2, Scenario B requires finding the current price of the underlying asset, where the call, put, and exercise prices are all given. Solve the put-call parity equation (

) for S.

- Problem 2, Scenario C requires finding the exercise price, where the call, put, and underlying asset prices are all given. Solve the put-call parity equation for K.

- Problem 2, Scenario D requires finding

for a call option worth $2.38 and a put option worth $3.60. Feel free to use the Black-Scholes spreadsheet from the course website, or better yet, create your own Excel spreadsheet in which you solve for the call and/or the put by varying

(this can be accomplished either via trial and error or better yet, by using either Solver or Goal Seek). An important lesson you’ll learn from this part of problem 2 is that call and put option prices are positively related to

.